Rent in Toronto is well beyond affordable in 2023. The continuous spike has encouraged some renters to reconsider purchasing a condominium.

Although higher borrowing costs have caused a temporary lull in condo buying activity, the Toronto Regional Real Estate Board commissioned a poll that suggests first-time buying activity should pick up noticeably this year. Despite the increased interest rates, mortgage payments on a condo are now closer to the cost of renting for more people. And then there’s the fact that owners are at least investing in a valuable asset when they buy.

Still, there is a lot to consider before moving ahead with such an important purchase. This is not to say that buying is not the right choice. Conversely, the purchasing process will be far less stressful if you understand what’s involved.

Table of contents

- Buying a condominium

- New condo purchases

- Paying for your new condo

- Hiring a lawyer

- Occupancy fees

- Land transfer taxes

- Condo fees

- Paying for your resale condo

- Securing a mortgage

- Obtaining a status certificate

- More condo fees

- Special assessments

- Legal issues

- After the purchase

Buying a condominium

In many ways, buying a condominium unit is like buying a house. But there are a handful of key differences.

For example:

- You become a member of a corporation and buy a share of the property’s common elements

- You are financially responsible for a portion of the common expenses

- You will need to follow rules, policies and bylaws established by the corporation

- You may need to contribute to a special assessment if a major unexpected repair is needed

Examining the corporation’s records before buying is critical so that you understand whether the building’s finances are strong or weak. It’s not a bad idea to speak to people living in the building either to find out what they like and dislike about their community. Having this information can help you make smarter decisions. But, you can only do this if you are buying a unit that already exists.

Purchasing a brand new condo comes with its own set of challenges and perks.

New condo purchases

The best part about buying a new condo unit is that you are the first one to live in it. Everything is clean and functional. Presale condos are also cheaper. The downside is that you might have to wait several years before you can move in.

Presale purchasing is almost a must

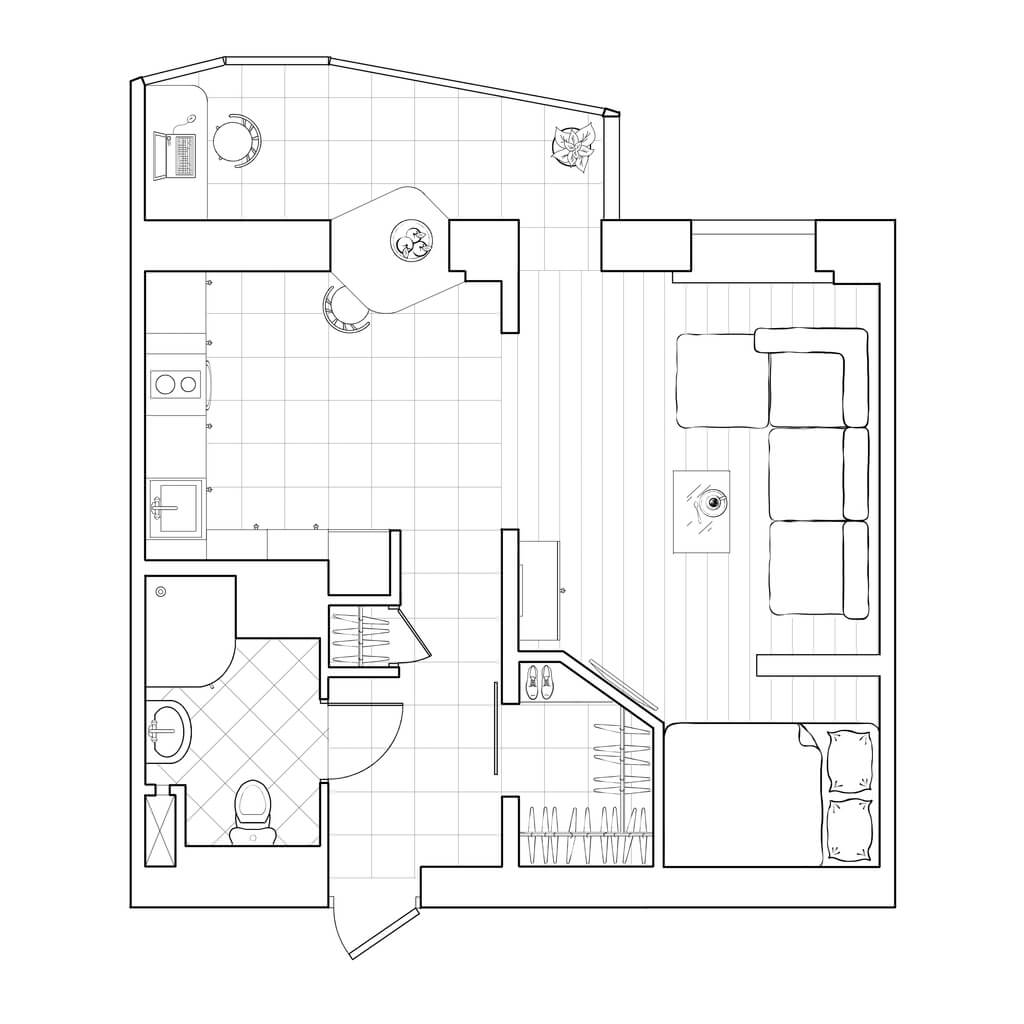

Developers put new condominiums up for sale before construction has even begun. While the building might not sell out right away, prospective buyers are going to snatch up 2 and 3-bedroom units as soon as they are available. If you are looking for a unit with more space, you can’t really wait and see how the building turns out. Instead, you will need to select your unit based on the floor plans.

The good news is you may be able to ask for custom changes when it comes to features or finishes before construction commences. The not-so-good news is that units can (and do) differ from the original plan, and the completion date is almost never what developers estimate it will be.

You will want to find out under what conditions the developer may change the completion date. Closer to completion, the developer should also be able to give you details about the property manager who will be responsible for day-to-day operations.

Disclosure statement

Under Section 72(2) of the Condominium Act, a purchase agreement for a new condominium is not binding on the purchaser unless they receive a disclosure statement. This collection of documents gives buyers all of the information they will need to decide whether or not to proceed with the transaction.

The package will contain:

- Copies of the proposed declaration, bylaws and rules, and other information that the Act requires

- The proposed budget

- Common expense amounts

- Proportionate shares upon which common expenses are calculated

- Condominium plans setting out the units

- Common elements

- Property management agreements

- Insurance trust agreements

A purchaser can also rescind the Agreement of Purchase and Sale within 10 days of receipt of a disclosure statement if they see something they don’t like. Buyers should consult an experienced condominium lawyer for assistance in reviewing the documents.

Paying for your new condo

Financing a new condo is normally divided into two phases: a down payment, which is the deposit made before you take ownership, and a mortgage, which covers the remaining balance.

Developers usually ask for a down payment between 5% and 20% of the total cost of the condo unit. The buyer will be required to make the deposit when they sign the preliminary contract. In Canada, If the down payment is less than 20% of the total cost of the condo, the buyer must obtain mortgage default insurance from the Canadian Mortgage and Housing Corp.

Lenders calculate your condo costs and weigh that against your income to determine your mortgage qualification. Your Gross Debt Service ratio (mortgage principal and interest + property taxes + heat + 50% of your condo fees) divided by your pre-tax income, should equate to 35% or less. Lenders look at your Total Debt Service ratio (GDS + car payments + alimony + other loans + the remaining 50% of your condo fees) divided by your pre-tax income. This should be 42% or less.

Hiring a lawyer

There are a lot of legal elements involved with purchasing real estate of any kind. So hiring a lawyer is a must. They will ensure your rights are protected, and act in your best interest if they see anything that needs your attention. Lawyers aren’t cheap, but they can help you avoid very costly mistakes.

Occupancy fees

In pre-construction condos, there are two types of closing. The first is interim occupancy and the second is the final closing.

Interim occupancy occurs when your unit is ready, but the condo building is not entirely complete. The builder will call you and schedule a time for you to sign some paperwork and collect your keys. In return, you will give them post-dated cheques to cover your interim occupancy fee.

The occupancy period normally lasts 3 to 6 months. The fee structure is determined by the builder, and will be in your purchase of agreement when you first sign your deal.

Land transfer taxes

In Ontario, the government charges a tax on the transfer of property ownership. The buyer always pays this tax. The tax is based on a percentage of the property value ranging from 0.5% to 2.5%, increasing with the value of the property.

The City of Toronto also charges its own municipal land transfer tax. So you will need to pay both if you are buying a condo in Toronto. However, first-time buyers are eligible for a rebate on both city and provincial taxes.

Condo fees

Owners are responsible for paying common expenses fees, or condo fees. A status certificate will tell you how much the fees are for your unit. The larger the condo is, the more money you will be expected to pay. Every owner must pay fees to the corporation.

Paying for your resale condo

When you buy a unit from an existing owner, it is considered a resale purchase. The biggest advantage to buying a resale condo is that you can see the unit and inspect it before you sign anything. The downside is that these units may require more maintenance, depending on their age.

These units will also be more expensive compared to presale costs. The current owner will want to receive more than they paid for the unit to ensure a reasonable ROI.

Except for the occupancy fees, buying a resale condo comes with all of the same costs as buying a new condo. There are a couple of other differences to highlight as well.

Securing a mortgage (it’s easier when you are purchasing a unit that already exists)

The mortgage process with a resale property is a lot easier because lenders aren’t making calculations based on educated guesses. They know the current interest rates, your current income, and what monthly condo fees are. When purchasing a resale unit, market shifts prior to closing aren’t such a big deal since you aren’t waiting several years for the unit to be completed.

Obtaining a status certificate

A status certificate is like a disclosure statement. You will want to review this collection of documents with a lawyer as they contain critical information about the unit you are interested in purchasing, including if there are outstanding fees that the current owner hasn’t paid.

The status certificate also provides information about the corporation’s financial health. By law, a corporation may not charge you more than $100 to prepare the certificate, including taxes and materials.

More condo fees

Older units may have higher maintenance fees. As a building ages, so do the systems and components that keep it going. Be aware of this if you are considering a building that is more than 15 years old.

Special assessments

Special assessments are levied when the corporation needs to pay for a major (usually unexpected) expense. See if there is a history of special assessments (a sign that funds probably haven’t been managed well) or if the cooperation just approved one. These assessments can cost each member thousands of dollars, and that’s one more big expense you’ll have to cover.

Legal issues

Confirm that there are no legal actions against the condominium corporation. Your fees may be hiked if the building is in the middle of a costly legal battle.

After the purchase

Once all of the paperwork is signed, you can celebrate the fact that you won’t be paying rent anymore! But the work is not yet complete. Below are some things you will probably need to do before or shortly after you move into your new unit.

Register with property management

Not only will you receive important notices, but you won’t have to worry that your deliveries will be sent back or lost in transit. You might also get a welcome package with the corporation’s governing documents, important contact information, and other information that will help you feel more at home. You may also be invited to create a profile for your resident portal if the company uses some form of condo management software.

Make sure nothing is broken

Do a thorough inspection of the unit to ensure all conditions of the purchase agreement have been fulfilled and the fixtures in the unit are in working order. If something is wrong, reach out to your lawyer and/or real estate agent as soon as possible to find out how to remedy the issue.

Learn about the condo board

As an owner and member of the corporation, you now have a stake in the management of the condominium. In order to have your say, you will need to attend member meetings.

It’s also in your best interest to get to know the people who are making decisions on behalf of the corporation. If you are interested in eventually running for a seat on the board, they can tell you how to get started.

Know your rights and responsibilities as an owner

Take some time to explore these resources aimed to educate and empower condo owners:

• The Condominium Act (provincial rules that govern condo corporations in Ontario)

• The Condominium Management Services Act (rules about property management)

• The Condominium Authority Tribunal (how to handle disputes in a condo building)