Keeping HOA reserve funds strong is a must for the longevity of shared community living. Therefore, the HOA reserve fund is a lifeline that ensures the community’s well-being in the face of unforeseen challenges.

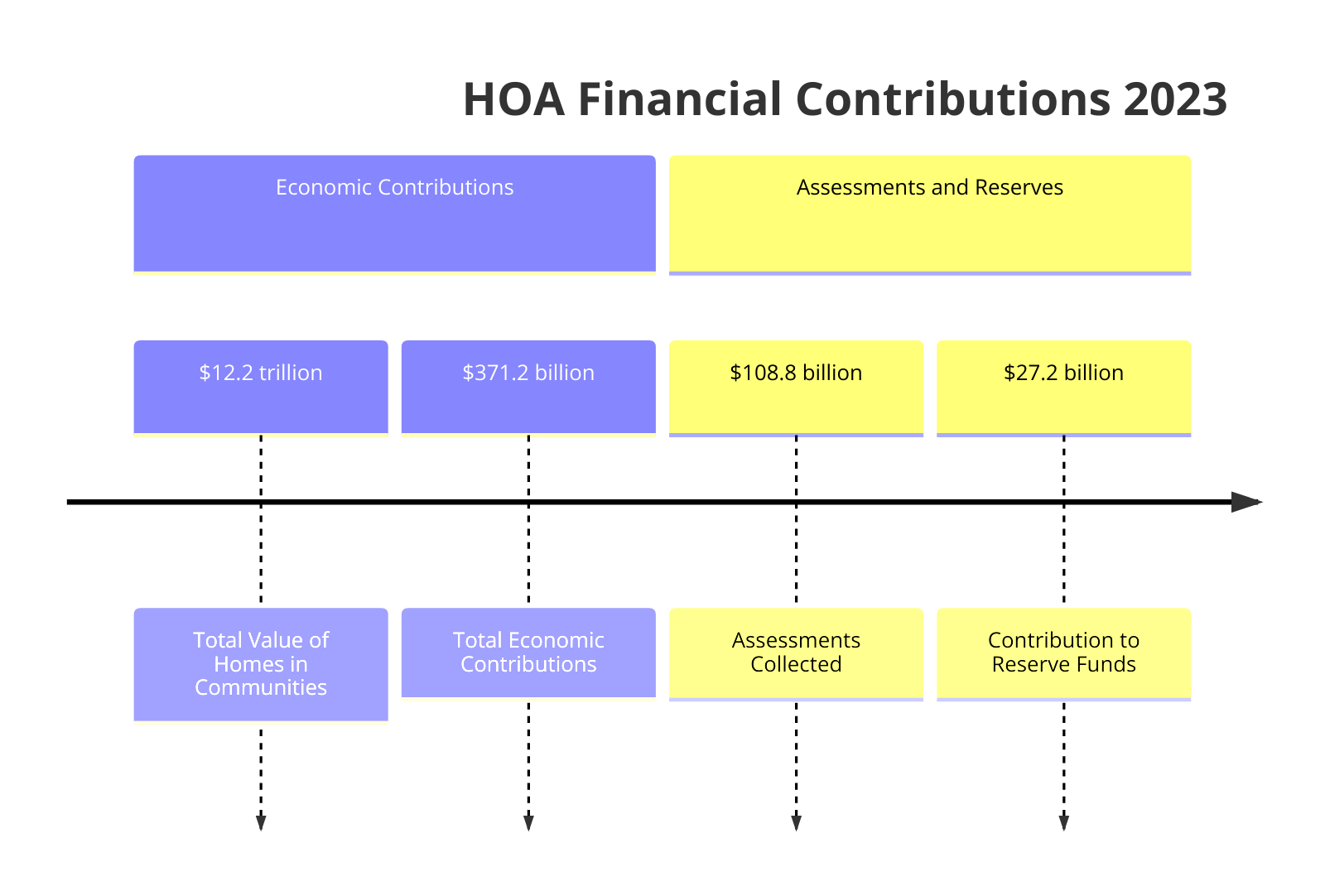

HOAs are stewards of billions of dollars. In fact, reserve funds used for repair, replacement and enhancement of common property totaled $27.2 billion worth of assessments in 2023 alone.

This means HOAs can certainly benefit from help to make sure this volume of funds are well managed.

Table of contents

- What is a HOA Reserve Fund?

- HOA Reserve Fund vs. Operating Fund

- Why You Need a Reserve Fund

- Understanding HOA Reserve Rules and Guidelines

- 6 Strategies to Empower Your HOA Reserve Fund

- Benefits of a Strong HOA Reserve Fund

- HOA Reserve Funds Benefit from Good Strategies

Let’s explore some strategies to help improve and manage your HOA reserve fund and see why it is important to do so.

What is an HOA Reserve Fund?

An HOA reserve fund is the collection of fees and dues from homeowners in a shared community that are set aside in an account. It is like a community’s financial safety cushion, where money is saved for maintaining essential components and current and future major repairs. Regular contributions ensure HOA reserve funds stay strong.

HOA reserve funds are more than a budget item; when managed well, it is key to the community’s overall financial well-being. So, financial experts suggest that reserve funds should be at least 70% or higher of calculated deterioration of a property.

HOA monies and operating monies are separate and different; but spending must follow HOA:

- Rules

- Regulations

- By-laws

HOA Reserve Fund vs. Operating Fund

| HOA Fund | Operation Fund |

| Used for large-scale projects • usually, future projects • used for common area structures (pools, foyers, hallways, laneways) | Used to finance recuring expenses • pay property management • maintain shared spaces • security services • janitorial services |

Why You Need a Reserve Fund

You need a healthy reserve fund because if the HOA does not have sufficient liquid assets available to cover expenses, then homeowners may have to succumb to a Special Assessment where they are obligated to pay substantial additional monies to cover an expense that the HOA reserve fund should cover.

For example, a reserve fund could be used to make repairs or replace roofing, however, if there are insufficient funds in the reserve, homeowners will be on the hook to pay thousands of dollars out of pocket for the cost to replace roofing in the community.

Reserve funds serve two crucial purposes:

- Handle major repair emergencies.

- Cover expensive planned future repairs and maintenance.

Life brings surprises and having enough funds for unexpected or large bills makes good sense.

Maintenance items, like replacing roofs or upgrading windows, are not an annual thing, but they do eventually need to be replaced. Reserve funds step in for these occasional but necessary expensive community repairs that can quickly add up.

Now, let’s look at what guides HOA reserve fund spending.

Understanding HOA Reserve Rules and Guidelines

The National Reserve Study Standards, established in 1998, offers a helpful guide for managing reserve funds. They focus on the association’s commitment to components, foreseeing project needs, and acknowledging significant costs.

The key principles for proper reserve funding are:

- Always ensure there’s enough money to cover future expenses.

- Maintain a steady and predictable contribution rate for consistency.

- Exercise prudence in financial management, ensuring every cent is carefully tracked.

With this resource in hand, you can also take strategic actions to strengthen your HOA reserve fund.

6 Strategies to Fortify Your HOA Reserve Fund

To foster community growth, it’s best to strengthen your HOA reserve fund. Think of it as giving your community a strong financial backbone. In this section, we’ll explore effective strategies that can help you do this.

1. Keep Your Reserve Fund Healthy

To ensure your community’s financial health, give it a regular check-up. Have a reserve fund study done, where a specialist, looks at your property and reserve account. This includes foreseeing repairs and improvements.

In the financial analysis the specialist checks your reserve fund’s current status and suggests how much money to regularly set aside. It’s smart to do this annually.

2. Know When to Use It

Your HOA reserve fund is not for everyday use. It’s crucial to use it wisely to benefit your association and community. As a board member, you should always act in the community’s best interests. Misusing these funds is not just an abuse of power but can also have legal consequences. To guide your decisions, ask yourself:

Is it a Recurring Expense?

If the expense is going to happen regularly, it’s likely an operating cost. In such cases, use your HOA’s operating fund instead of dipping into the reserve.

Is it a Capital Improvement?

Adding something new to your community, like a facility or feature, is a capital improvement. Reserves are strictly for replacements, repairs, and unexpected costs. For planned additions, there should be a separate budget or fund in place.

3. Make Financials Transparent

Transparency is key when it comes to your community’s finances. Underfunded reserves are often due to a lack of clear accounting practices.

To avoid this, ensure your accounting clearly distinguishes between regular assessments (dues paid by homeowners) and reserve fund contributions (percentage of dues set aside specifically for the reserve fund).

By listing them separately on your income sheet, the board and community can get an accurate view of each account, and homeowners can see exactly where their money is allocated. On the expense side, be sure to have a distinct line item for reserve contributions. This not only keeps the community informed about the money going into reserves but also assures everyone that the board is fulfilling its fiduciary duty.

4. Be Prepared for Future Expenses

Avoid being one of many underfunded HOA reserve funds. While calculating future expenses might seem intimidating, the process is simpler than it appears.

Start by:

- Assessing the lifespan of the major capital systems in your association

- Gauge how much life they have left

- Estimate the cost of repairs or replacements when these systems deteriorate

- Calculate the annual savings needed to cover these future expenses.

5. Ensure Proper Financial Reporting

Use a structured approach for financial reporting. Being accountable to your residents and ensuring the responsible use of funds demands meticulous financial records.

Your property management company or accounting team should compile essential reports, including:

- Balance Sheet

- Income Statement

- Cash Flow Statement

- General Ledger

- Accounts Payable Report

- Account Delinquency Report

- Cash Disbursements Ledger

These reports affect your reserve fund, providing a comprehensive overview. Additionally, a specific reserve fund report can spotlight how the fund is being managed to keep it healthy.

6. Invest Reserve Funds Wisely

Deciding what to do with your reserve fund is a bit like choosing between safety and growth. You can opt for the security of savings account, where your fund remains safe and shielded from market crashes. However, the downside is minimal growth, with interest barely ticking over a percent each year.

On the flip side, investing your HOA reserve fund brings more risk, especially with stock market fluctuations. Yet, if you make wise investment choices, your fund could grow significantly over time.

The best decision depends on your community and the HOAs risk tolerance. A middle ground might be the way to go—consider allocating some funds for conservative money market investments or low-risk stocks while keeping the rest securely in the bank. This way, you strike a balance, earning some growth without putting your entire fund at risk. It’s about finding the right mix for your community’s financial well-being.

Benefits of a Strong HOA Reserve Fund

Maintaining a robust reserve fund isn’t just a financial task; it’s a commitment to responsible community stewardship. Here are four compelling reasons to apply these strategies when managing your HOA fund reserves:

1. Demonstrates Responsible Board Action

Well-funded reserves showcase the board’s responsible management of association funds. This instills confidence in homeowners, assuring them that their most valuable asset—their home—is safeguarded.

2. Savings for a Rainy Day (literally)

Flash flooding is unexpected and may cause subsequent damage. Adequate reserves provide a safety net for unforeseen events, like floods, fire, earthquakes and more. Having the necessary funds on hand removes the financial burden from homeowners and avoids the need for special assessments, offering financial security during unexpected crises.

3. Builds Trust with Lenders

Lenders view a well-funded reserve positively. It signals that the association is less likely to resort to special assessments or face financial strain in the case of repairs or natural disasters. This confidence from lenders improves the likelihood of mortgage approvals for potential buyers.

4. Enhances Community Appeal

The overall appeal of a community directly influences property values. Proper reserves enable associations to handle unexpected expenses and asset replacements, contributing to improved resale values. This not only keeps current homeowners satisfied but also attracts new buyers who see a financially stable and well-maintained community.

HOA Reserve Funds Benefit from Good Strategies

A well-funded reserve creates a foundation for a resilient and financially sound community–and this requires good strategies.

So, remember when managing your HOA reserve fund apply:

- Regular analyses

- Spending within the proper parameters

- Preparedness

- Transparent accounting practices

- Wise investing

- Proper reporting

As you fortify your HOA reserve fund and refine your existing practices, always keep in mind the ultimate goal—building a community that stands strong today and secures a prosperous tomorrow!