Accounting is a tedious, but crucial responsibility for condo and HOA property managers. Information is power, and management needs to be deeply familiar with the financial health of their properties in order to plan for the present and the future. If you care for a community, you may have to take on this role yourself, or you may have an accounting administrator to do the heavy lifting. Either way, tracking revenue and expenses for your clients can feel like a chore, even at the best of times.

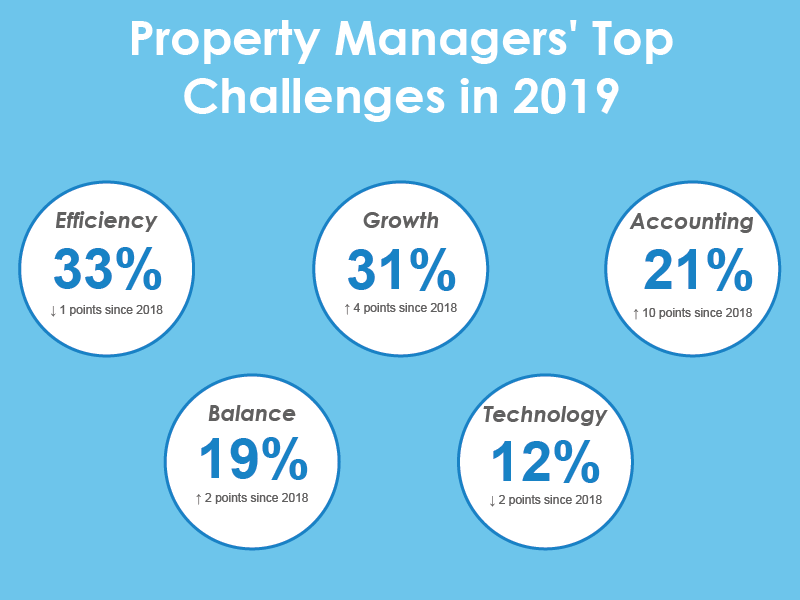

In fact, accounting continues to be one of the key challenges for property managers.

As seen in the diagram above, technology can also be a struggle – but that doesn’t mean you should shy away from it. Several property managers have found that accounting software can significantly boost productivity and accuracy. The software automates some of the really time-consuming processes, and it’s much easier to keep track of everything using an online system as opposed to paper records or Excel spreadsheets.

Why does this matter? Because reliable software has the potential to tackle some of the other key issues that property managers grapple with, namely, efficiency and growth.

Now, for the tricky part, which accounting system is right for you? There are a lot of options out there, so we’ve done a bit of research for you and found the programs that property managers prefer to use.

QuickBooks

QuickBooks is an accounting software system developed by Intuit. It was designed specifically for small and medium-sized businesses, and offers on-premises accounting apps as well as cloud-based versions. You don’t need an accounting background to use QuickBooks, which is why so many small and independent managers decide to invest in this accounting system. QuickBooks can assist with processing and automating online payments from residents, tracking income and expenses, payroll, taxes and bill management.

Pros

- Easy to use, you don’t need to be a tech wizard to benefit from QuickBooks

- Integrates with other software

- Connects to the association’s bank account and automatically tracks payments and deposits

- Free-trail available

- New updates to the software are made regularly

Cons

- More expensive than some other software programs

- Cost of desirable add-ons can add up

- May be delay recording transactions from bank account

Buildium

Buildium caters to property managers, and has created a cloud-based accounting software system just for them. It handles property-level and company-level accounting and financial reporting. The program allows you to track payments, manage accounts payable, reconcile bank accounts, and generate comprehensive reports. Buildium comes with about 50 different reports that you can share with clients and investors. Convert work orders into bills so that you can pay them online, and set up automatic payments for recurring items.

Pros

- It’s easy to learn and train others on

- Specifically made for property management

- 1099 filing services are readily available

- Easy to share accounting information with boards

- Free 14-day trial available

Cons

- Can be cost-prohibitive for smaller companies

- Additional setup costs and usage fees can add up quickly

- Limited customization capabilities

- It is an American program and does not have a sales tax component like HST or GST in Canada

AppFolio

AppFolio can be used for community associations as well as residential and commercial property management. Its accounting software aims to boost efficiencies, improve data accuracy, and make accounting and bookkeeping as simple as possible. AppFolio has a special Smart Bill Entry that uses AI technology to automatically process invoices with ease and speed. Like most accounting software systems, residents have the ability to make online payments, but property managers can also create tenant charges in bulk, analyze key performance insights and automatically issue late fees.

Pros

- Very comprehensive accounting system

- Values security and has strong security measures in place

- Easy to see exactly what residents owe and what they have paid

- Several customization options

Cons

- There may be too many features for very small companies or associations

- Certain protections have been put in place to minimize accounting mistakes. However, these protections create extra steps that property managers must work through

- May be challenging to connect with customer support

Yardi

Yardi offers two platforms designed for real estate management: Yardi Voyager and Yardi Breeze. Both include accounting for residential and commercial portfolios. Voyager is a more comprehensive system that can handle advanced services, run custom reports, and leverage big data. Voyager lets you track ledgers, calculate fees, transfer scheduled charges and track maintenance, and more. Breeze is a very simple system that can help property managers with the basics. If you outgrow Breeze, Voyager is a natural next step.

Pros

- Yardi integrates with other software systems

- Ability to support small and large companies and associations

- Expandable list of tools

- Cloud-based access allows you to make updates from anywhere

Cons

- Voyager may not be as simple to learn as other accounting systems

- Payment processing is an additional cost

- Can be a costly investment for small associations

TOPS

TOPS features a robust accounting engine that is supported by comprehensive automation and extensive customizability. It’s powerful enough for accountants, but property managers with no accounting experience are the intended users. Property managers can enjoy pain-free collections, a customizable ledger system and seamless partner integrations.

Pros

- Award-winning customer support

- Integrates with other software

- Allows unlimited users

- More affordable than some accounting software systems

Cons

- Setup may be a challenge

- Many clients have experienced recurring bugs or glitches

Condo Manager

Condo Manager is a completely integrated suite of tools put together to assists property managers with all of their accounting needs. You can customize and automate tasks such as accounts payable/receivable, recurring transactions, cheque printing, digital signing, electronic payments, budget management, collection of common expenses, bank reconciliation, and more. There are even vacation rental and apartment rental modules available.

Pros

- More affordable than some accounting software

- Integrates with other software systems

- It supports an unlimited number of units and condo corporations

- Easy to use

Cons

- No mobile app

- Data conversions may be a little tricky when onboarding a new association

- Mixed reviews about customer support

Property Vista

All property management software focuses on accounting, but Property Vista works hard to produce customer-centered tools that allow property managers to clearly see the entire picture. Monitor the financial health of your properties, collect online payments, and spend more time growing your business. Property Vista has also thought about the little details that ultimately make a big difference for communities. It works best for portfolios of over 250 units. Property Vista is proudly Canadian and its headquarters are located in Toronto.

Pros

- Easy for property managers, boards and residents to use

- System offers all the essentials that property managers are looking for

- Very little negative feedback from Property Vista users

Cons

- No free trial

- Minimum of 100 units/homes required for implementation

Benefits of using software for accounting instead of manual Excel sheets

No matter what property management software for accounting you go with, you’re almost guaranteed to save yourself a lot of time and avoid many accounting headaches. That’s because online systems are better organized, maintain a more structured format, and allow for easier data sharing.

Excel spreadsheet can get the job done, but because there is no formal structure in place, you might decide to track expenses using one format for one month, and use a different format the following month. When it comes time to make a quarterly or annual report, putting all those numbers together can be agonizing. Then there’s the issue of saving data locally on a desktop or laptop. Some property managers do have the online version of Excel, but if you don’t, there’s no efficient way to access or update data if you’re not by your work computer. If you’re managing multiple properties, or a few very large properties, you must be extremely organized and detail-oriented if you decide to use Excel. One wrong entry could lead to a costly mistake.

Here is some more information to think about if you’re considering switching from spreadsheets to online accounting software.

It’s estimated that spreadsheets can consume an average of an hour each day for the average office worker, and 2.5 to 3 hours a day for finance and R&D roles. That’s a lot of time, and for property managers, it’s time they don’t have. Spreadsheets are often inefficient, very challenging to work with when caring for multiple properties, and they can introduce unnecessary risks to your business.

Speaking of risks, approximately 70% of all businesses would be expected to fail within 3 weeks if they suffered a catastrophic loss of records due to fire or flood, or fatal computer issue. In the real estate industry where records are such a critical part of day-to-day operations, this number could be even higher.

Physical paper records are even more time-consuming. Though most have abandoned this accounting method, tracking down paper to complete accounting tasks manually can take up to 40% of the time allocated for this responsibility.

Software Advice, a trusted provider of detailed software reviews, spoke with 385 property management professionals and found that 53% still had not switched from manual to automated software systems, reported BuildingMinds. Only 28% had done so, and 9% claim that they do not run their businesses on any system.

However, eliminating manual processes is no longer something that is ‘nice to have’; it’s quickly becoming a necessity that’s critical to a property management company’s growth. Plus, companies can reduce along the lines of 2-4% of total real estate portfolio spend when they acquire technology to help them streamline tasks.

Taking advantage of technology to automate accounting (and other repetitive processes for that matter) is a smart move because it makes your job so much easier. It is an investment, but it will quickly pay off.

If that’s not enough to convince you, we’ve found some more compelling points about why it may be more beneficial to use online software for accounting:

- Excel formulas are complex and prone to human error. Accounting software does the heavy lifting for you, so you don’t even have to think about calculations

- Spreadsheet errors are easy to make, but can be very hard to find. A user-friendly template can make data entry easier on your eyes and your brain. Some programs even interpret the data for you, so you only have to verify that the numbers are correct

- Different income streams require different spreadsheets to track earnings. This means as you continue to acquire new clients, the number of spreadsheets will increase. Trust us when we say you want to manage fewer of these, not more

- When you have a clear financial view from the start, you don’t need to worry about making uninformed decisions for your properties

- Share reports or invoices right away. Simply search for the data you need and send off a report

- It is possible to generate helpful, high-level reports, such as a profit and loss sheet, from accounting software to help with business planning. If you use Excel, you’d have to put this report together by hand

- It’s far easier to send electronic invoices to clients. If you use Excel, you will need to create a separate system for sending, receiving, and taking care of payments

- The companies that design accounting software specifically for property managers understand what these professionals are looking for. They can help you isolate the data you really need, create premade templates that make sense, and help you keep this sensitive information safe and secure

- A proper audit trail ensures your data cannot be compromised

Excel is a great program for storing small amounts of simple data, and it can still help with limited accounting functions. However, as your property management business grows and the data multiplies, you’ll be happy to have a tool that can simplify and streamline accounting processes for you.

1 problem solved…

Adding accounting software to your routine will make a world of difference, but as every property manager knows, that’s only one aspect of the job. The good news is online software isn’t limited to accounting; there are some really great tools that can help you with communication and management, too. Some property managers may question whether they should invest in accounting software or property management software, but we would suggest investing in both.

Property management software is useful to both property managers and residents. From streamlining service requests/work orders, to tracking violations, to improving communication systems, property management software means less frustration for your communities, and more productivity for you.

Condo Control Central, for example, has over 40 features available. However, property managers only need to use the features that they need. The platform is scalable and customizable, and is remarkably easy to use.

Some of the features that property managers can’t live without include:

Amenity Booking – Design professional-looking amenity pages and showcase all of the amenities that your building has to offer. Add real photos, customize hours of operation, limit the number of users allowed at one time, create timeslots for facilities like the gym, include detailed descriptions, and much more. You even have the power to link amenities, making a potentially complicated booking process incredibly easy for residents. Residents can book and pay for amenities on the go if they have the CCC app on their phone. This adds an additional layer of convenience.

Architectural Change Requests – Instead of trying to separate architectural change requests from other common service requests, let our software system help you identify time-sensitive architectural change requests that have been submitted by owners. All requests are stored in one place, so you never have to go looking for them. Use the filter to view requests by type, or use keywords to find specific requests. If board members must have the final say, they are able to view and vote on architectural change requests from their CCC account, and can include comments about why a request was approved or delayed. The applicant receives the responses and can make changes once the request has been approved.

Announcements – Announcements can be delivered via email, text, or voice to all community residents, or specific groups. Create a new message from your phone or laptop. Send announcements right away, or schedule them for a later date. You can even include attachments, such as newsletters or updates to rules and regulations, to every announcement.

E-Voting – Increase voter participation and reach quorum on the first attempt. Our electronic voting module lets you collect online votes from owners in advance of an AGM or special meeting. The e-voting process is the same as the regular voting process, however your condo or HOA may reach quorum before the meeting takes place (and owners prefer the added convenience).

File Library – Property managers must keep thorough, up-to-date records to succeed, but figuring out how to store everything can be challenging. Our File Library allows property managers to store everything in secure, organized online files. You can use the quick search functionality to find any file in a matter of seconds.

Public Websites – Promote your community to prospective buyers and residents with a clean and professional website. Make contact information readily available, share photos of units or homes, highlight your best amenities. You can also include login and registration buttons to your public website so that owners and residents have easy access to the Condo Control Central portal. From here, they will be able to access the system to submit service requests, catch up on announcements, book amenities and more.

Service Requests / Work Orders – Instead of submitting a paper work order or service request to you, residents can submit requests to the system on their computer or phone. All requests can be found in once place, and you receive an email when a new request has been submitted.

Violation Tracking – This feature allows for the systematic enforcement of rules and regulations. Send warning letters or formal violation notices directly to residents, and track the progress of each violation. You can create as many different types of violations as you need for your properties, and regulate who can administer violations. Everything is done online which means you don’t have to work with paper reports. Residents can even pay fines associated with violations online.

Another notable benefit of using property management software is that you use significantly less paper. This helps the environment and at the same time, reduces the money you spend on printing and mailing documents. On average, our customers see a 40 – 60% reduction in paper costs within the first 3 months of signing up.

Property management software can simplify documentation procedures and automate most processes, giving you the opportunity to focus on improving your services and growing your business.

Too much of a good thing

While we do encourage property managers to find robust accounting software and property management software, we wouldn’t recommend having too many platforms on the go at the same time. If an association is asked to use one program for email, another for package tracking, and a different program for online payments, this ends up creating more inefficiencies, and things may start to fall through the cracks. The whole point of this software is to make things easier and simpler; beware of too much of a good thing.

It’s important to do your research and make sure you are selecting one or two programs that will accommodate all of your needs. This is a big decision, so take the time to identify the issues that you really want to resolve or improve, speak with sales representatives about the specifics of the software they are providing, see if the program allows for integrations, and ensure the software can grow with you.

Conclusion

More and more professionals are turning to property management software for accounting because it saves associations money, and allows property managers to do more in less time. Furthermore, it provides a clearer financial picture, and helps with short-term and long-term budgeting.

Property managers who use both accounting and property management software are generally more organized, less stressed, and better prepared to take on new clients.